SIMPLE BOOK KEEPING FOR NANO AND MICRO ENTERPRISES

Book keeping is an act of keeping business financial records. It is the means by which you capture your day-to-day business transactions. It is the means by which you give daily account and reports of your daily business transactions. It helps you understand the behaviour of your business, the customers and the market. Although book keeping is an important aspect of accounting, you do not need to be an accountant to understand and apply simple basic book keeping in your business’s financial management as a nano and micro scale entrepreneur. In this brief write up you will understand book keeping in its most basic form and put what you learn to immediate use.

Why bookkeeping?

Why do you need to understand and apply book keeping skills? No business can be said to be well organized if its financial records are messed up or mixed up. Your business may be growing but without good financial records progress is difficult, if not impossible, to trace. Many entrepreneurs claim they know the business too well to know when they are making profits or losses, but many such businesses may be making losses with mental calculations but may in fact be making profits that are actually leaking away without their knowledge if traceable records are not kept.

A business may be making losses not because the products or services are not selling, but because the sales are not properly juxtaposed against costs and expenses. Proper record keeping therefore helps you trace where the monies are coming from, how they come and how they go and for what. Book keeping, therefore, records, tells and traces your financial history.

Let us look at some more other merits of or reasons for book keeping.

- Book keeping shows the health and wealth of your business per time

- Book keeping shows how much money your business receives

- Book keeping shows how much money your business pays out

- Book keeping shows how much money your business owes

- Book keeping shows how much money your business is been owed

- Book keeping helps you control how much money your business spend

- Book keeping helps you identify leakages in your finances before it gets too late

- Book keeping enable you plan, organize and prioritize ahead

Types of Records to be kept in Book Keeping

There are different records that must be kept in as you carry out your business activities. These include:

- Purchase record – this is the records of purchases of your goods. It is also known as purchase journal. This may be purchases of raw materials (if you produce or manufacture your items) or the purchases of ready-made items/products (if you buy and sell). Ensure that your purchases are invoiced where possible and that purchases made on credit are recorded here.

- Stock record – this is the record of your raw materials that will be used to manufacture or produce or fabricate what you sell or supply. These may be raw food items and ingredients (if you operate restaurant, for instance) or other materials like leather, soles, threads etc., (if you manufacture shoes or other leather products, for instance).

- Inventory record – this is the record of items that are now ready to be sold. This may be the already made product which are already displayed for sales. In fact, any of your used tool or equipment that you no longer use but need to sell and raise cash from should be recorded in the inventory also.

- Sales records – this is the records of your daily sales. Ensure that sales made on credit are recorded here.

- Income record – this records all monies that enters into your business. This takes care of cash inflows.

- Expense record – this is also called expenditure records and it records all expenses or cash outflows from your business.

Getting started

As said earlier, this is just a simple or simplified approach to book keeping for nano and micro enterprises for immediate application. As your business expands in volume or advances in scopes a more expanded and advanced approach can be applied. Here below is how to kick-start and keep a very simple daily business transactions records.

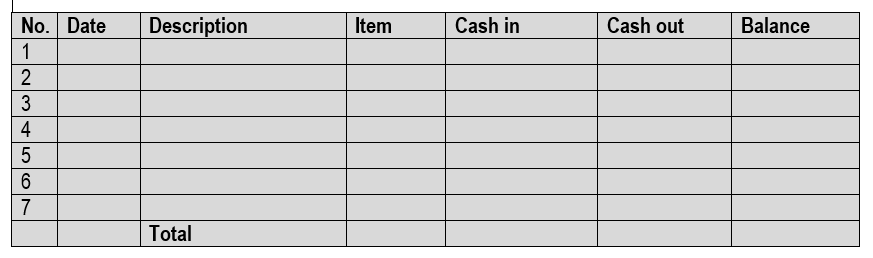

For simple start, get a note book and rule the pages as shown below. This example shows basic income and expense record.

Always remember that paper does not lie. If you fail to record your transactions you will forget them tomorrow. Even old women who cannot read and write make marks on the walls to remind them of transactions. Let every day’s transactions go down on record. Starting with date, describe the transaction under “Description” (you may include quantity and rate in the “Description” column or rule two more columns for them) then name the item under “Item”.

Enter the amount under “Cash in”. If it involves an amount you are spending from, it is helpful to use the first roll to enter the amount and term it as “brought forward” or “B/F” under “Description.” The amount under “Cash out” is to be subtracted from the amount under “Cash in” then the difference is entered under “Balance”. All these are added up vertically from top down to determine the total of each. Please, note that the rolls can be as many as your book can contain.

Detailed practical training awaits you at DPat Foundation secretariat.